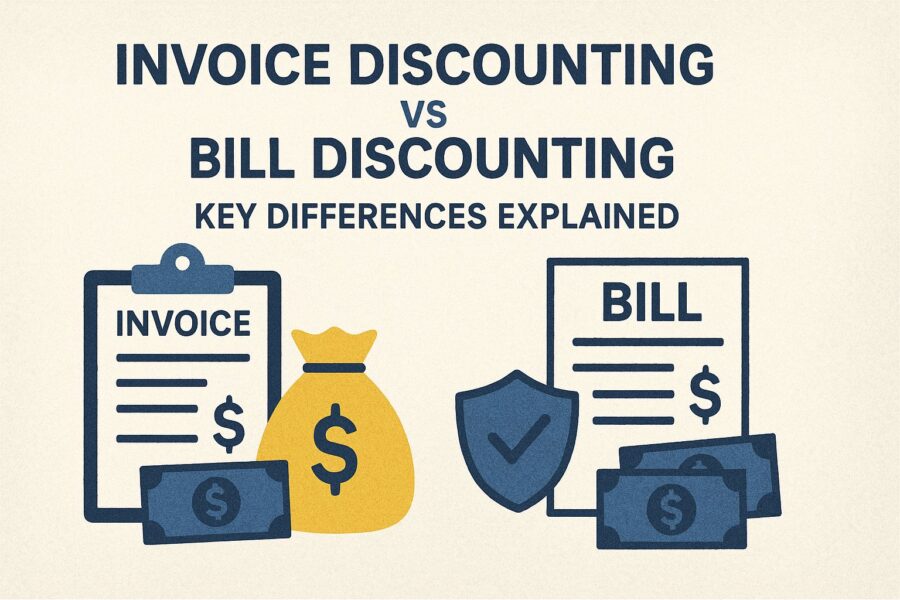

Invoice Discounting vs Bill Discounting: Key Differences Explained

- 31 Oct 25

- 8 mins

Invoice Discounting vs Bill Discounting: Key Differences Explained

Key Takeaways

- Invoice discounting functions as a loan against unpaid invoices, whereas bill discounting operates as a bill of exchange, where businesses receive funds against bills due within a specific time frame.

- Invoice discounting usually covers unpaid invoices due within 90 days, while bill discounting applies to bills due between 30–120 days, offering relatively more flexibility in terms of payment duration.

- In invoice discounting, the process is confidential, meaning customers are unaware of the arrangement. Bill discounting, however, is not confidential, as buyers know the bill has been discounted.

- The cost of invoice discounting is generally higher due to increased lender risk. In bill discounting, the seller bears the collection responsibility, often leading to lower charges depending on creditworthiness.

- Invoice discounting is best suited for large corporates or companies with significant sales ledgers, while bill discounting fits businesses of all sizes looking to stabilize short-term cash flow.

Will your business be able to afford waiting for payments, or do you need your cash flow to pick up now? While your consumers may require extra time to pay the bills for purchases from your business, your enterprise could demand quick liquidity. As forms of potential solutions, 2 of these options emerge: invoice discounting (due within 90 days) and bill discounting (due between 30 – 120 days).

But which one is right for your organisation? Let's explore the various differences, benefits, costs associated and the downsides of invoice discounting vs bill discounting.

Key Differences between Invoice Discounting vs Bill Discounting

Invoice discounting is essentially a subset of invoice financing. The lender, in this case, extends a loan to the business against their pending invoices. On the other hand, bill discounting serves as a bill of exchange.

The table below shall highlight the key differences between invoice discounting vs bill discounting:

| Parameters | Invoice Discounting | Bill Discounting |

| Nature of the Financing Option | Loan | Bill of Exchange |

| Terms of Payment | Unpaid invoices which are due within 90 days | Bills which are due between 30 and 120 days |

| Flexibility Factor | Limited to certain invoices | Comparatively flexible |

| Purpose | Get the funds for unpaid invoices | Get the funds for any bills receivable |

| Confidentiality | Confidential | Not confidential |

| Suitability | Suit businesses which have specific invoice financing needs | Such businesses which have varying terms of bill payment |

| Size of the Company | May suit the large corporates or those with higher sales ledger capital requirements | It may be better for businesses which vary in size, depending on the bill payment terms. |

| Risk Associated | As per the terms agreed upon, the seller or the financer takes the risk | The seller is responsible if the buyer doesn't clear the debt |

💡If you are a GST-registered business, consider using the PICE App for quick and easy business transactions.

Detailed Idea about the Difference Between Invoice Discounting vs Bill Discounting

Invoice discounting and bill discounting are 2 financing modes which advance money against the unpaid invoices. They provide the necessary working capital to the companies. The phrases are often used interchangeably, but as we've already established above, they have distinct meanings.

So, let's get into what they offer business owners regarding accessing funds against their accounts receivable, in further detail. Read more about their differences below:

- Meaning

Say that you're a small/medium-sized business waiting to be paid by your clients. The wait can seem disruptive, right? This is where the tool of invoice discounting comes in handy.

- You can quickly and hassle-free access the money you're owed.

- When you send over an invoice to the customer, a lender pays you a chunk of the owed amount upfront.

- It acts much like a short-term loan, with your invoice as collateral.

- The lender gives you most of the amount before your client pays.

On the other hand, here’s what bill discounting entails:

- It is a way to borrow money against the bills which are yet to be cleared.

- When you give your unpaid bill to a third-party company, they pay you most of the money upfront.

- The company checks the creditworthiness of any parties involved. Accordingly, they charge interest and fees.

- You still chase the payment as you would typically, but get your hands on the cash you require sooner.

- The Process

Invoice discounting can prove to be a valuable tool for businesses with larger profit margins (which absorb any interest costs). Here's what the working process looks like:

Step 1: Deliver the goods/services to clients.

Step 2: Provide them with an invoice enlisting necessary information, like amount due, transaction date and contact details.

Step 3: If any client is slow to make the payment, use invoice discounting to get the needed funds.

Step 4: Submit your invoices to your lender/financial provider. They will review and verify the invoice information.

Step 5: Provide remittance details, which you’ll find on the invoice document.

Step 6: Wait for the lender to determine the loan amount on the basis of the invoice value.

Note that the rate of interest and time it takes for fund receipt will depend on your company, the financing company and invoice totals.

Step 7: As per your agreement, either the lender or you may be handling the billing/payment process and the collection of the payment from the client.

Note that you'll have to follow the standard collection rules to recover the outstanding amount.

Step 8: After the client pays the invoice amount, your lender shall reimburse you for the pending balance (without the interest/service fees).

Next, here is a step-by-step explanation of how the bill discounting process works:

Step 1: You, the seller, will sell the goods on credit to the buyer.

Step 2: Formulate the invoice and present it to the buyer. They must accept and agree to pay by a set due date.

Step 3: You may then approach a financial institution to negotiate and settle on a discount on the invoice.

Step 4: The financial institution shall cross-check the bill’s authenticity and the buyer’s creditworthiness.

Step 5: Post-verification, the financial institution shall provide you with the funds, subtracting a margin, fee and discount.

Step 6: You then receive the amount and utilise it for transactions in the future.

Step 7: As the due date arrives, either you or the financial institution in question collects the payment from the buyer. This depends on the agreement established between the two parties.

- Benefits

Invoice discounting allows for quick access to cash. It is easier than applying for bank loans and is associated with more planning flexibility. Invoice discounting also helps preserve customer relationships and provides collateral for lenders. This reduces risk and increases chances of approval.

Bill discounting is associated with advantages like improved cash flow and quick access to funds. There is no requirement for collateral as the invoice itself serves as security. It's a debt-free option for financing which doesn't impact balance sheets. This makes it a great choice for businesses of all sizes that want to boost their working capital.

- Cost Involved

Invoice discounting calls for borrowing against invoices, which adds to liabilities. Businesses, financing companies and invoice totals all have an effect on the interest rate. The lender shall also charge interest as well as a service fee. Costs generally depend on the creditworthiness of the buyer and seller.

Bill discounting costs depend on one’s credit history and invoices. It may be associated with lower costs owing to the fact that the seller assumes debt collection responsibilities. Invoice discounting is more expensive due to the associated higher lender risk. Collections are attended to by the business.

5. Confidentiality

In the case of invoice discounting, your clients won’t know that you’re using a financial tool, as it is completely confidential. Handle communication and follow-ups with your clients as you otherwise would. However, the bill discounting process is open. The clients know that the bill has been discounted.

Conclusion

Both the financing options, namely invoice discounting and bill discounting, offer value to businesses. They each come with their own set of advantages. The choice between the two, however, depends on a business's particular financial requirements, long-term growth objectives and client relationships.

By figuring out the difference between invoice discounting vs bill discounting, businesses will be able to make informed decisions. Thus, they can boost their working capital management efforts and optimise cash flow.